Adyen Refusal reasons

A transaction can be blocked either by the bank, or by the risk profile of the merchant. The most frequent reason is that Adyen receives a negative response from the bank. This can have multiple causes: the card number or CVC is incorrect, insufficient funds or authentication required.

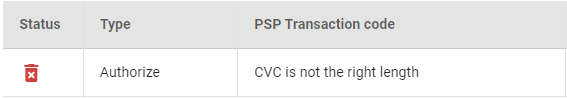

You may see the reason for the refusal in the payment studio under the payment details

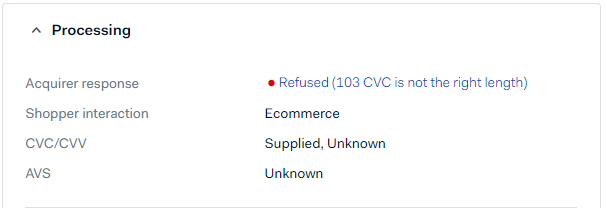

However, for the exact refusal reason you will need to check in Adyen

The most common refusal reasons are as follows;

| Refusal Code | Description |

| 05: Do not honor | This is a generic refusal that has several possible causes. In about half the cases, it is just another way of saying Insufficient funds. Unfortunately, we do not get more specific information on the exact refusal reason. The only way to find out the exact refusal reason is the shopper reaching out to the bank to ask for it. The shopper should contact their issuing bank for clarification. |

| 51: Insufficient funds/over credit limit / Not sufficient funds | Insufficient funds in the cardholder's account. The shopper can try again after adding funds to their bank account, or use another payment method. |

| 59: Suspected fraud | The transaction is refused because the card issuer suspects this payment to be fraudulent. |

| 65: Authentication required | Applies for Mastercard. Authentication is required for the transaction. If the transaction is in scope of PSD2 and did not go through 3D Secure, retry with 3D Secure. This is also referred to as a "Soft Decline". |

| 83: Fraud / Security | Applies for Mastercard. The transaction is refused because the card issuer suspects this payment to be fraudulent. |

| 1A: Authentication Required | Applies for Visa. Authentication is required for the transaction. If the transaction is in scope of PSD2 and did not go through 3D Secure, retry with 3D Secure. This is also referred to as a "Soft Decline". |

Below is a full list of Refusal Reasons for Visa and Mastercard;

| Refusal Code | Description |

| 01: Refer to card issuer | The transaction was refused by the card issuer. The shopper should contact their bank for clarification. The shopper can try again after resolving the issue with their bank, or use another payment method |

| 03: Invalid merchant | The transaction was refused by the card issuer. The shopper should contact their bank for clarification. The shopper can try again after resolving the issue with their bank, or use another payment method. |

| 04: Capture card / Pick-up | The card issuer requests to retain the card. This can be due to a suspected counterfeit or stolen card. This reason is used in an E-Commerce environment although it originates from a POS (Point Of Sale) environment. |

| 05: Do not honor | This is a generic refusal that has several possible causes. In about half the cases, it is just another way of saying Insufficient funds. Unfortunately, we do not get more specific information on the exact refusal reason. The only way to find out the exact refusal reason is the shopper reaching out to the bank to ask for it. The shopper should contact their issuing bank for clarification. |

| 06: Error | Payment could not be authorised and resulted in an error. The shopper can try again or use another payment method. |

| 07: Pickup card, special condition | The card issuer requests to retain the card. This can be due to a suspected counterfeit or stolen card. |

| 10: Partial approval | The transaction was cancelled. Some card issuers support partial-approval authorization. This approves a part of the requested transaction, leaving the remainder to be paid with another form of tender. |

| 12: Invalid transaction | The card issuer does not allow this type of transaction on this card/account. For example, the card is a fleet card for which this type of transaction is not permitted. |

| 13: Invalid amount | The card issuer has declined the transaction because of an invalid format or field. This response usually occurs with Cirrus or Maestro Debit and Prepaid Cards or cards that are not allowed to do online purchases. The shopper should retry or use another payment method. |

| 14: Invalid card number | The card issuer is unable to validate the card/account number. |

| 15: Invalid issuer | The card number is not within a card number range supported by the scheme. |

| 19: Re-enter transaction | Applies for Visa. The transaction cannot be processed temporarily. |

| 30: Format error | The card issuer does not recognize the transaction details being entered. This is due to a format error. The shopper should check the transaction information and retry. |

| 41: Lost card | The card was reported as lost. Validate the shopper's authenticity and refer them to their bank. |

| 43: Stolen card | The card was reported as stolen. Validate the shopper's authenticity and refer them to their bank. |

| 46: Closed account | Applies for Visa. The account is closed. Re-validate the account number for accuracy and do not reattempt with the same PAN or token. |

| 51: Insufficient funds/over credit limit / Not sufficient funds | Insufficient funds in the cardholder's account. The shopper can try again after adding funds to their bank account, or use another payment method. |

| 54: Expired card | The card expiration date is in the past. The shopper should correct the date or use another payment method. |

| 55: Invalid PIN | The shopper has entered an incorrect PIN. The shopper should re-enter their PIN or use another payment method. |

| 57: Transaction not permitted to issuer/cardholder | The card issuer does not permit the transaction on this card/account. The shopper can use another payment method. For activation or loading of prepaid cards, the Merchant, acquirer BIN, and issuer BIN are not all domestic. An issuer's processing center is not certified to receive transaction-specific data in TLV format (field 104 in request message). |

| 58: Transaction not permitted to acquirer/terminal | Card issuer does not permit the transaction on this card/account. Shopper can use another payment method or contact their bank. |

| 59: Suspected fraud | The transaction is refused because the card issuer suspects this payment to be fraudulent. |

| 61: Exceeds withdrawal amount limit(s) / Withdrawal amount limit exceeded | The shopper has exceeded their card limit. The shopper can try again after resolving the issue with their bank, or use another payment method. |

| 62: Restricted card | The card issuer has restricted where the card can be used. For example, because of embargoes. |

| 63: Security violation | The card issuer indicated a security issue with this card. The shopper can use another payment method. Alternatively, the shopper can try again after they resolved the issue with their bank. |

| 65: Exceeds withdrawal count limit / Withdrawal count limit exceeded | The shopper has exceeded their card usage frequency limit. The shopper can use another payment method or try again with the same card after the shopper took care of the card limit issue. |

| 6P: Customer ID verification failed | Applies for Visa. Incorrect account verification (for example driving license number) related to Visa Direct. Not to be confused for cardholder verification method refusals such as CVV, for example. |

| 65: Authentication required | Applies for Mastercard. Authentication is required for the transaction. If the transaction is in scope of PSD2 and did not go through 3D Secure, retry with 3D Secure. This is also referred to as a "Soft Decline". |

| 70: Contact Card Issuer | Applies for Mastercard. The card issuer indicated an issue with this card and requests contact from the shopper. The shopper can use another payment method. Alternatively the shopper can try again after they resolved the issue with their bank. |

| 70: PIN data required | Applies for Visa. The card issuer requests to use Secure Customer Authentication. Reattempt transaction with PIN. (European Region Only) |

| 75: Allowable number of PIN tries exceeded | The shopper has entered an incorrect PIN more times than is allowed by the issuing bank. The shopper should retry or use another payment method. |

| 78: Invalid/nonexistent account specified (general) | The transaction is from a new cardholder, and the card has not been properly unblocked. |

| 79: Life Cycle | Applies for Mastercard. The transaction is refused due to invalid card data. |

| 80: Credit issuer unavailable | The issuing bank cannot be contacted. The shopper should retry or use another payment method. |

| 82: Policy | Applies for Mastercard. The transaction is refused due to a policy reason. |

| 82: Negative online CAM, dCVV, iCVV, CVV, or CAVV results or Offline PIN authentication interrupted | Applies for Visa. The cardholder verification method failed for CAM, dCVV, iCVV, CVV or a service code for card present transactions. |

| 83: Fraud / Security | Applies for Mastercard. The transaction is refused because the card issuer suspects this payment to be fraudulent. |

| 86: Cannot verify PIN | Applies for Visa. The PIN cannot be validated. If applicable, the transaction can be reattempted as a non-PIN transaction. |

| 91: Authorization Platform or issuer system inoperative / Issuer not available | The issuing bank cannot be contacted. The shopper should retry or use another payment method. |

| 92: Destination cannot be found for routing / Unable to route transaction | The shopper is using a test card number on live. The shopper should use another payment method. |

| 93: Transaction cannot be completed; violation of law | The issuing bank will not allow this transaction. The shopper should use another payment method. |

| 96: System malfunction | The issuing bank cannot be contacted. The shopper should retry or use another payment method. |

| 1A: Authentication Required | Applies for Visa. Authentication is required for the transaction. If the transaction is in scope of PSD2 and did not go through 3D Secure, retry with 3D Secure. This is also referred to as a "Soft Decline". |

For Amex, they return these refusal reasons;

| Refusal Code | Description |

| 100: Deny | This is a generic refusal that can have several possible reasons. Shopper should contact their issuing bank for clarification. |

| 101: Expired Card / Invalid Expiration Date | The card expiration date is in the past. The shopper should correct the date or use another payment method. |

| 106: PIN tries exceeded | The shopper has entered an incorrect PIN more times than is allowed by the issuing bank. The shopper should retry or use another payment method. |

| 109: Invalid merchant | The transaction was refused by the card issuer. The shopper should contact their bank for clarification. The shopper can try again after resolving the issue with their bank, or use another payment method. |

| 110: Invalid amount | The transaction amount was specified in an invalid format. For example, an invalid character such as a dollar sign or a space was used. The shopper should correct or use another payment method. |

| 111: Invalid account | The card issuer is unable to validate the card/account number, possibly because an invalid character was used. |

| 115: Requested function not supported | The card issuer does not allow this type of transaction on this card/account. |

| 119: Transaction not permitted to Cardmember | The card issuer doesn't permit the transaction on this card/account. The shopper can use another payment method. |

| 122: Invalid Keyed Printed Card Security Code (PCSC) | The card issuer indicated a security issue with this card. The shopper can use another payment method. Alternatively, the shopper can try again after they resolved the issue with their bank. |

| 125: Invalid Effective Date on Card | The card expiration date provided is not a valid date format. The shopper should correct or use another payment method. |

| 130: Additional customer identification required | Authentication is required for the transaction. If the transaction is in scope of PSD2 and did not go through 3D Secure, retry with 3D Secure. This is also referred to as a "Soft Decline". |

| 181: Format error | The card issuer does not recognize the transaction details being entered. This is due to a format error. The shopper should check the transaction information and retry. |

| 187: Deny New Card Issued | The card issuer supplied the cardholder with a new card. The shopper should retry with the new card, or use another payment method |

| 189: Deny Canceled or Closed Card Acceptor | The merchant has stopped operations or is no longer accepting cards from this card scheme. |

| 200: Deny pick up Card | The card issuer requests to retain the card. This can be due to a suspected counterfeit or stolen card. |

| 900: Advice accepted | The ExpressPay issuer is unable to respond to an ATC Synchronization Authorization Request. |

| 911: Card Issuer timed out | The issuing bank cannot be contacted. The shopper should retry or use another payment method. |

| 912: Host unavailable | The issuing bank cannot be contacted. The shopper should retry or use another payment method. |